Find Guidance In Science 🧬

4X Journal's guided exercises were developed with input from Trading Performance Coaches, Neuroscience therapists and over 200 peer-reviewed papers. This user-friendly system will improve the way you think, feel and act.

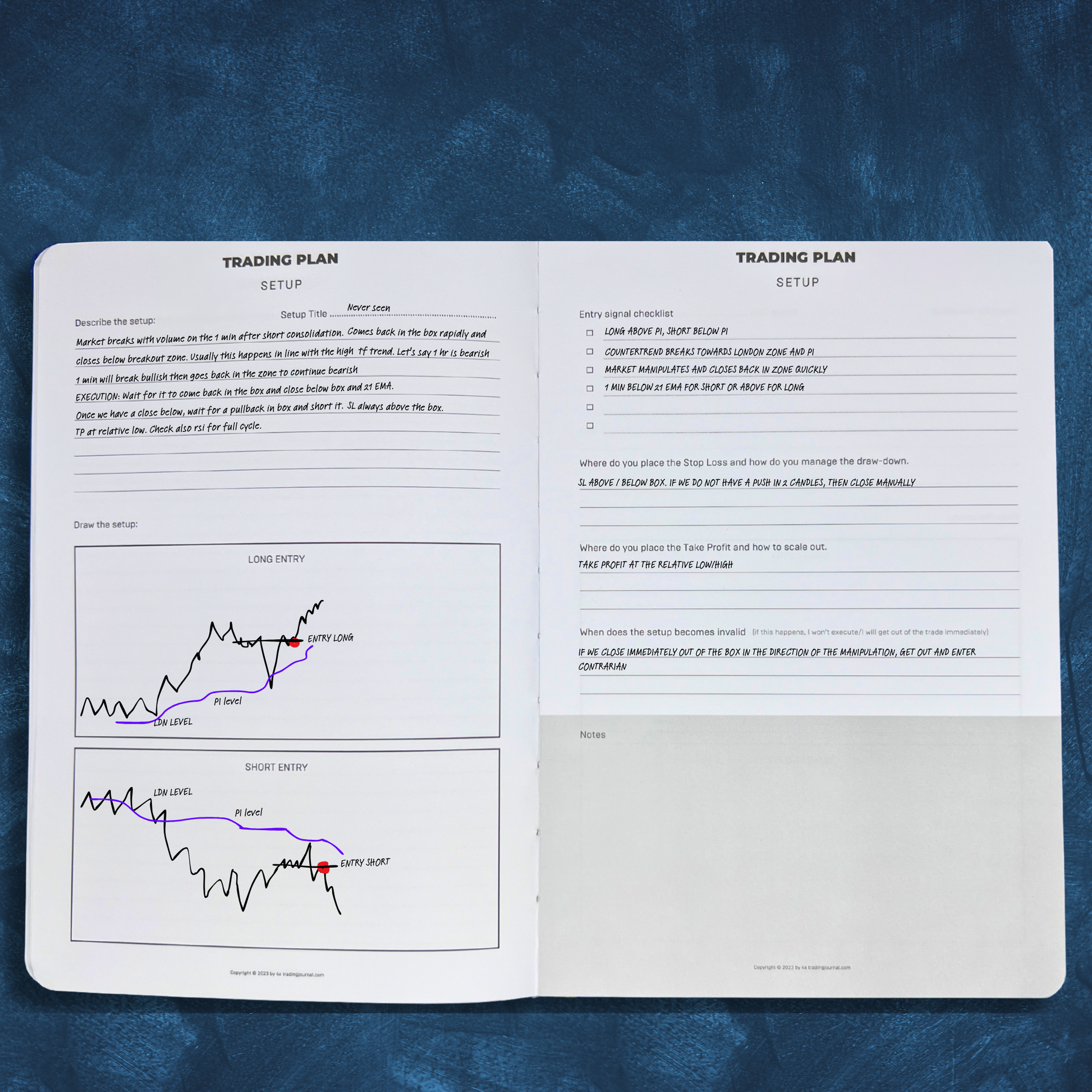

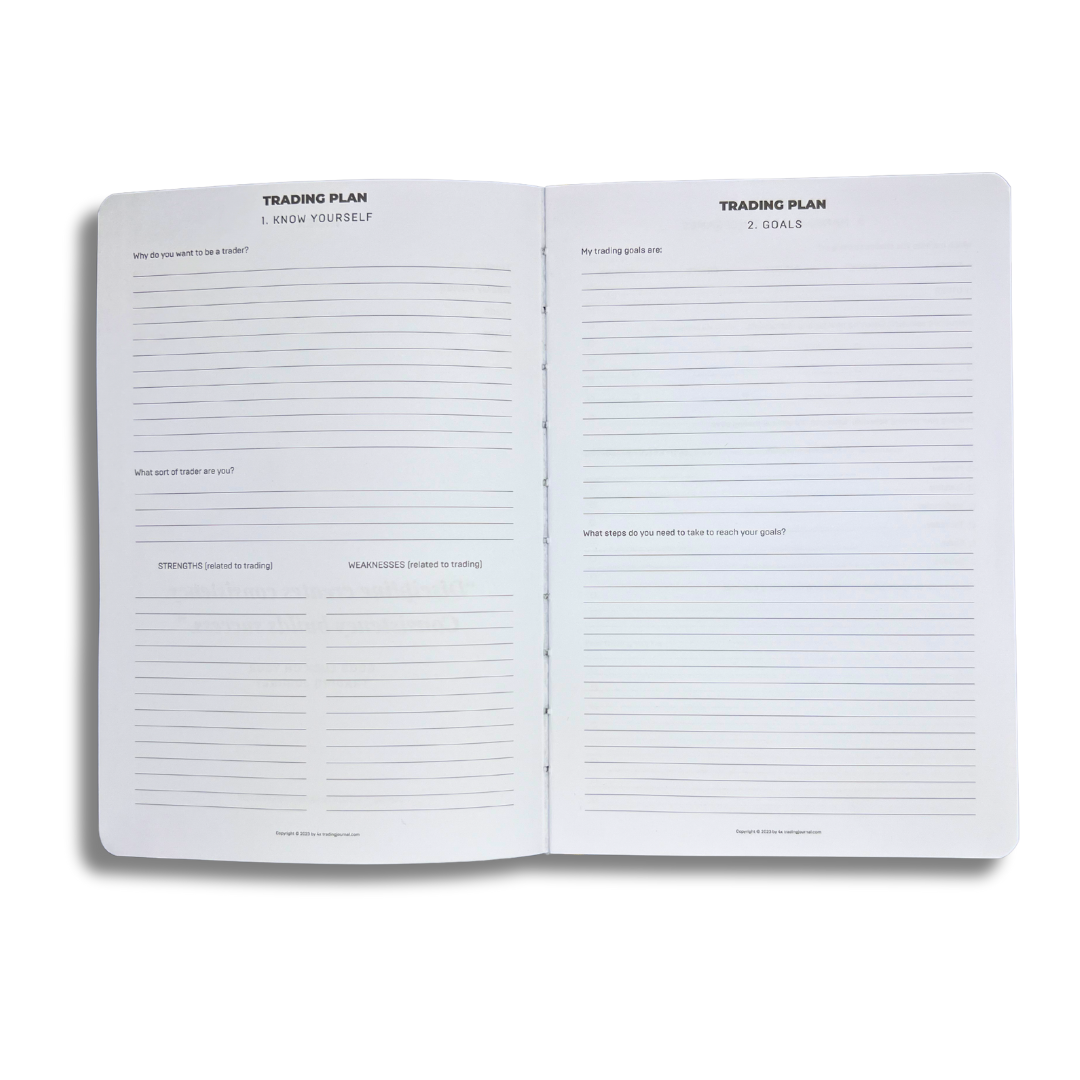

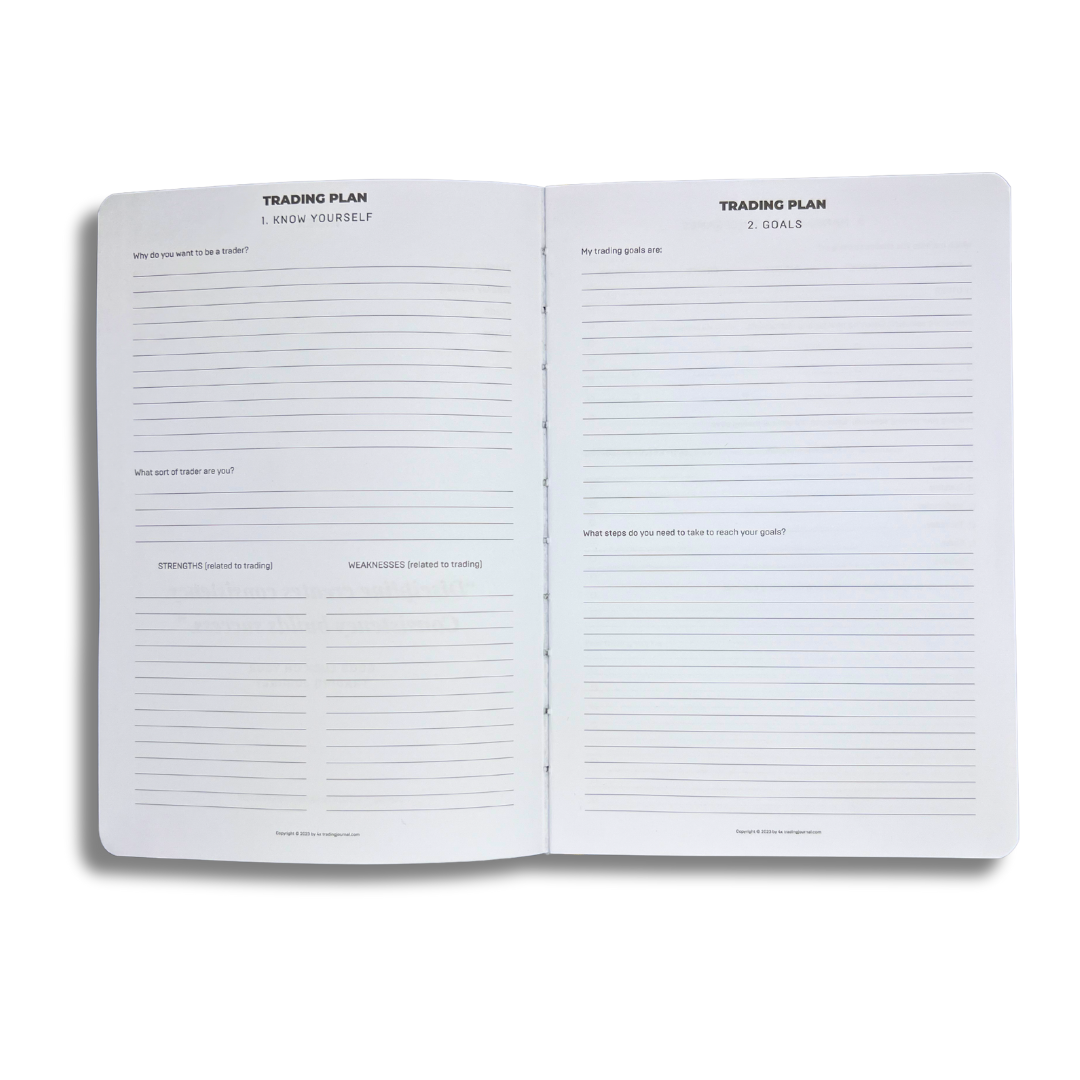

Build your Trading Plan

Unlock major clarity by setting up the foundation for success.

Contains:

- Know yourself Better

- Strenghts and Weaknesses

- Market & Timeframes

- Risk & Money Management

- Discipline Rules

- Strategy Overview

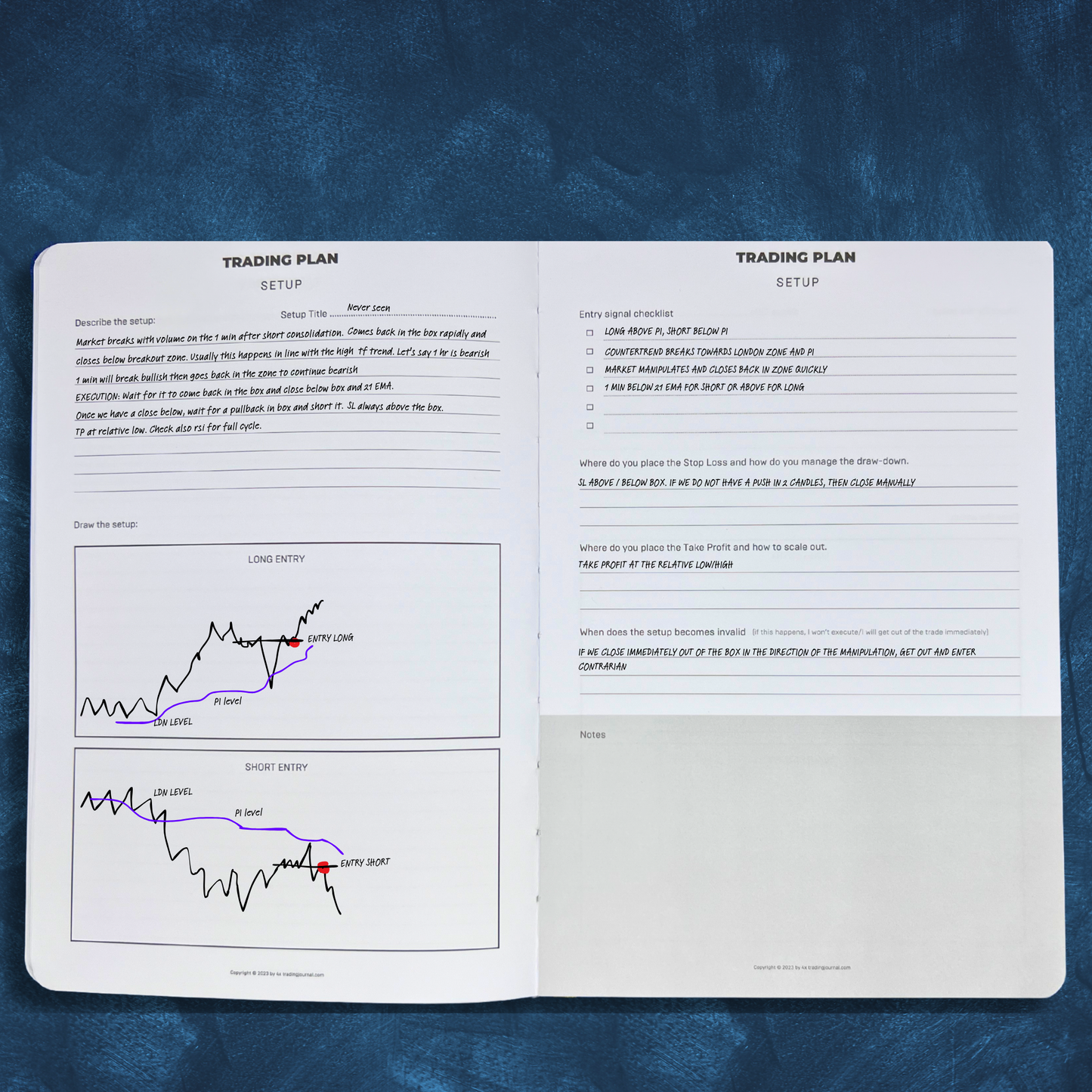

- Define Your Setups

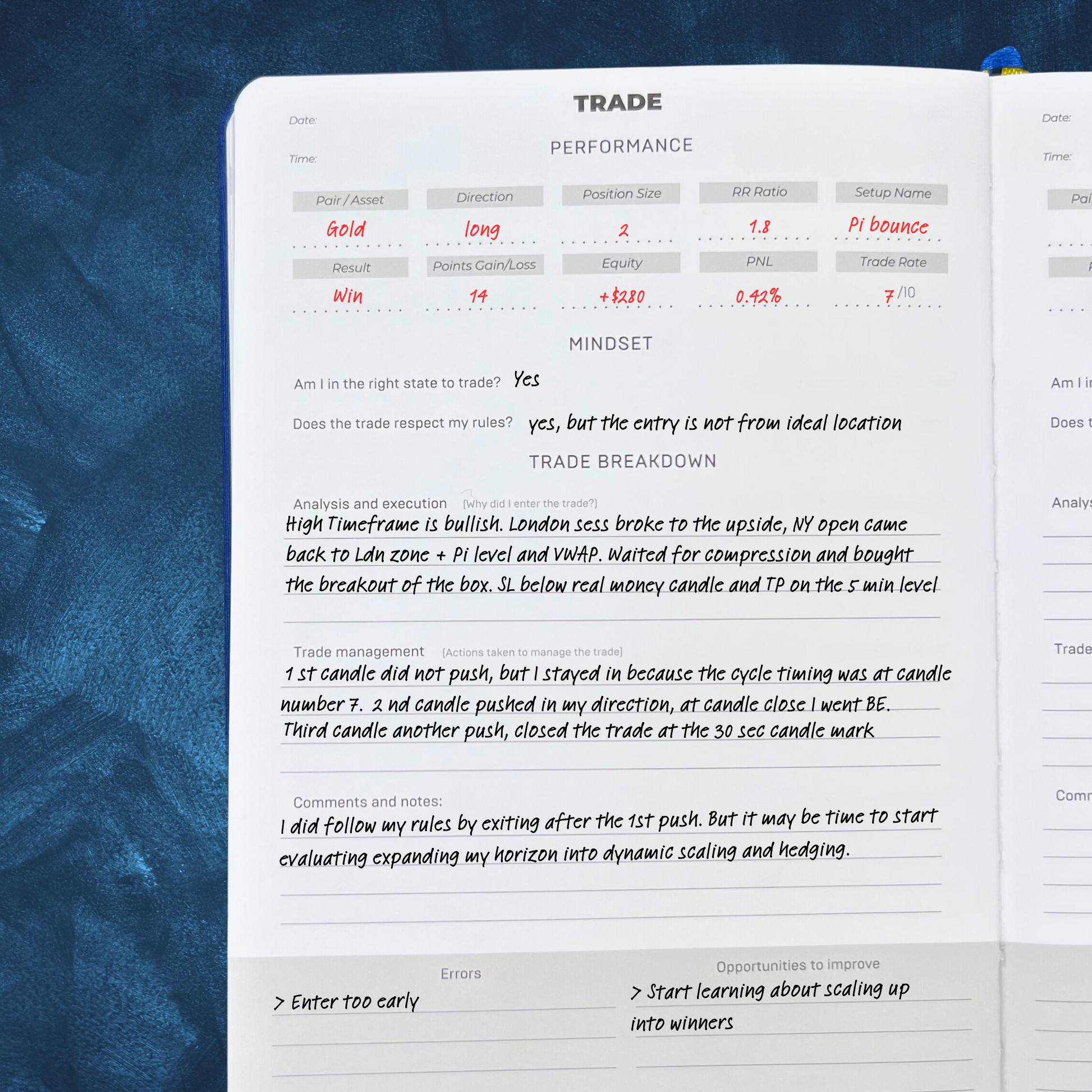

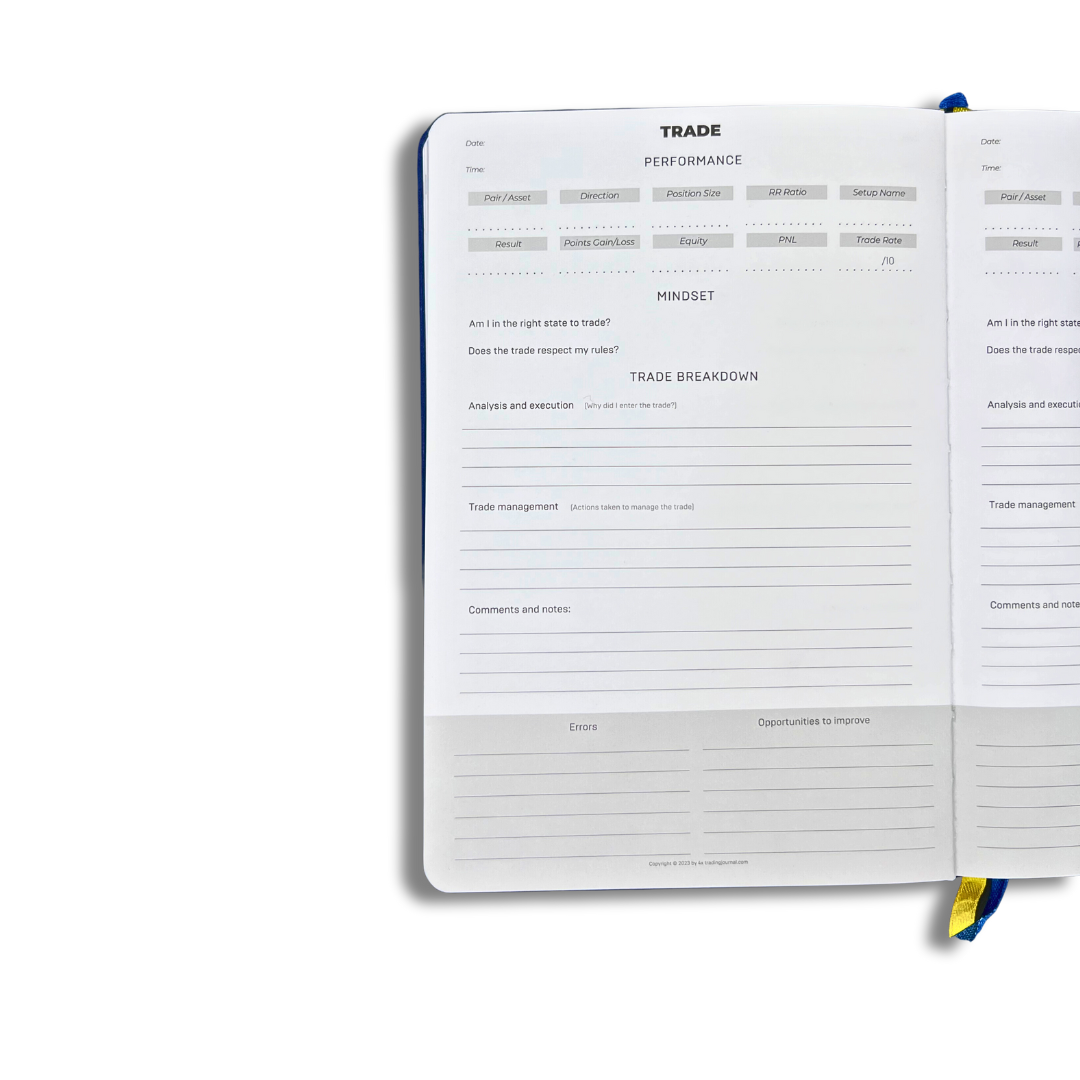

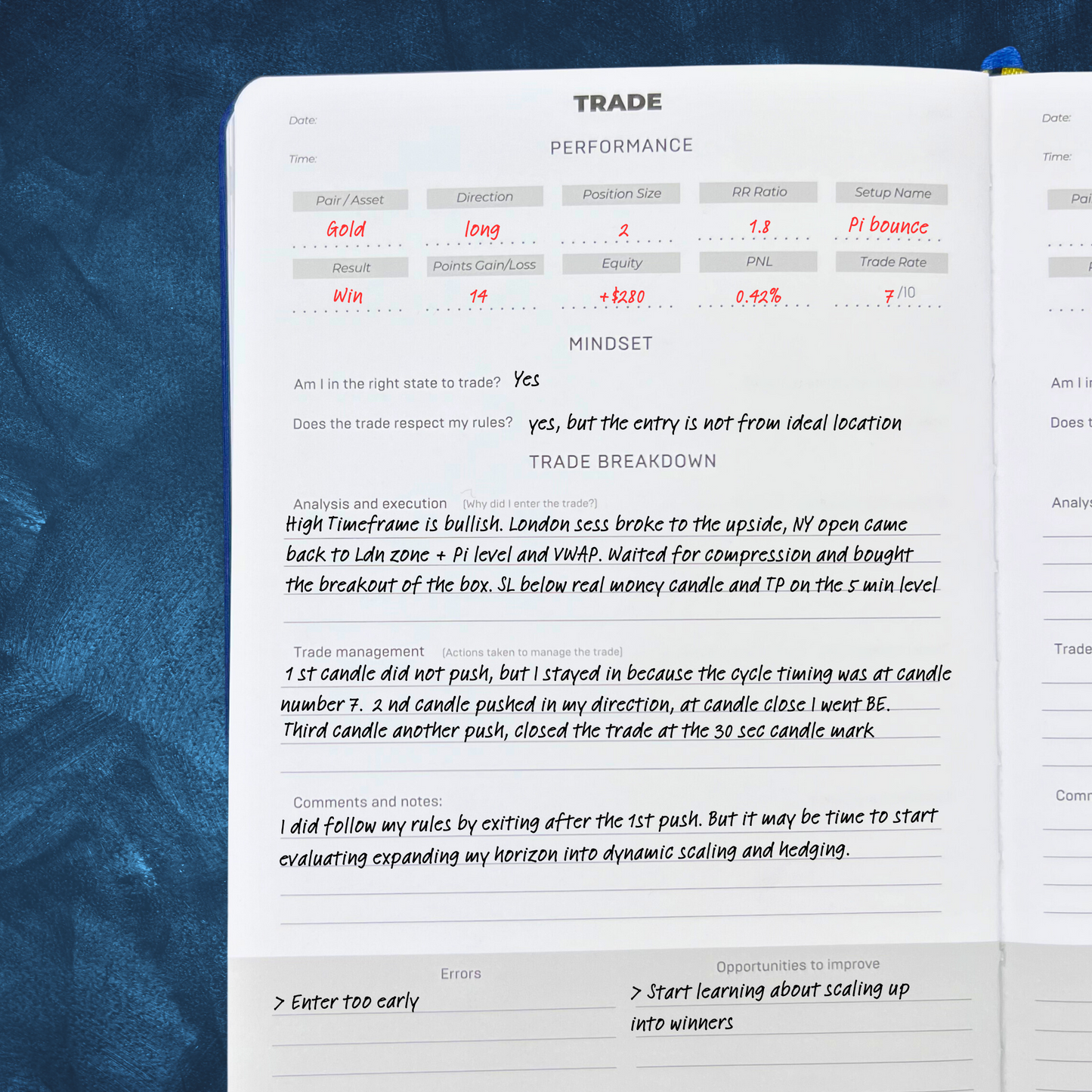

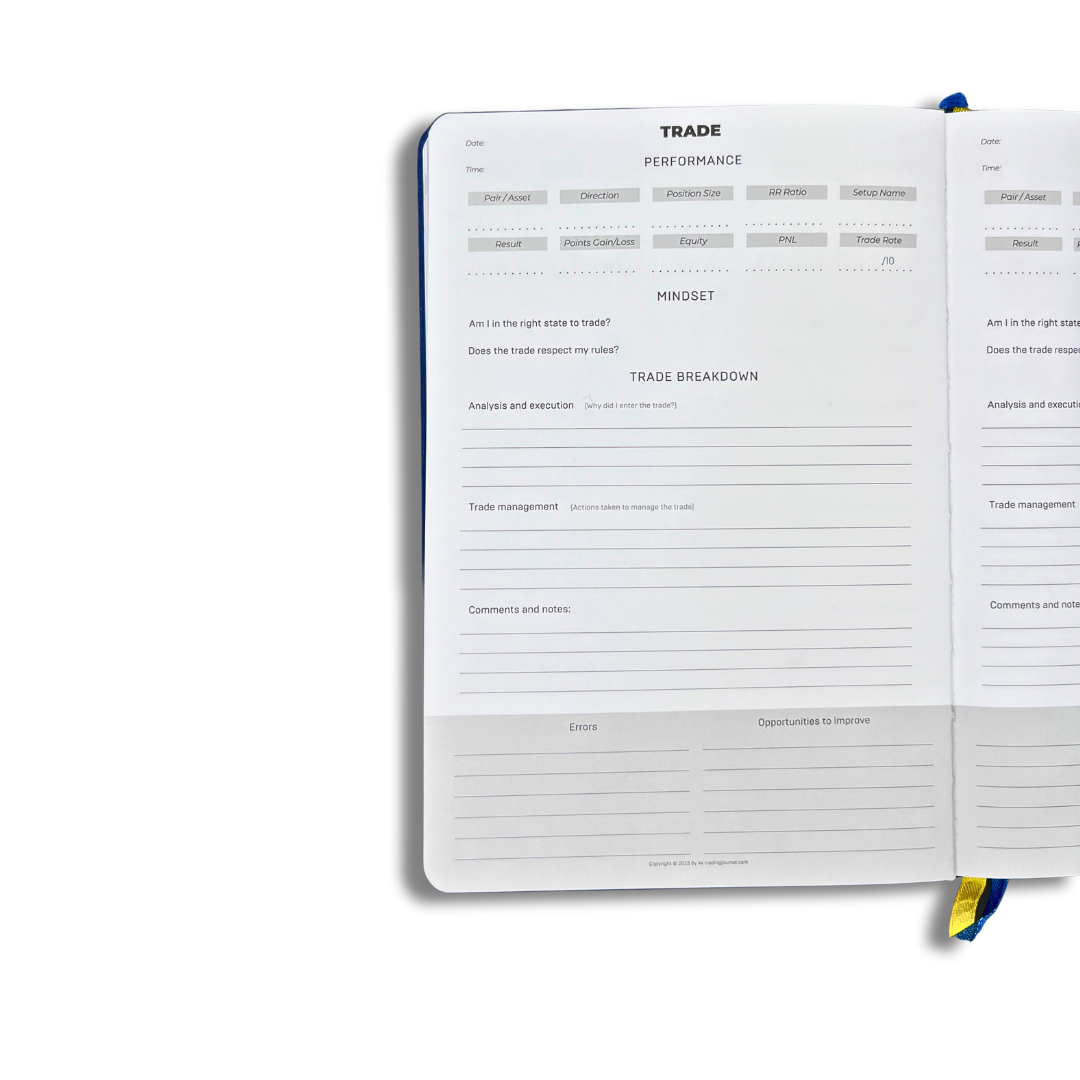

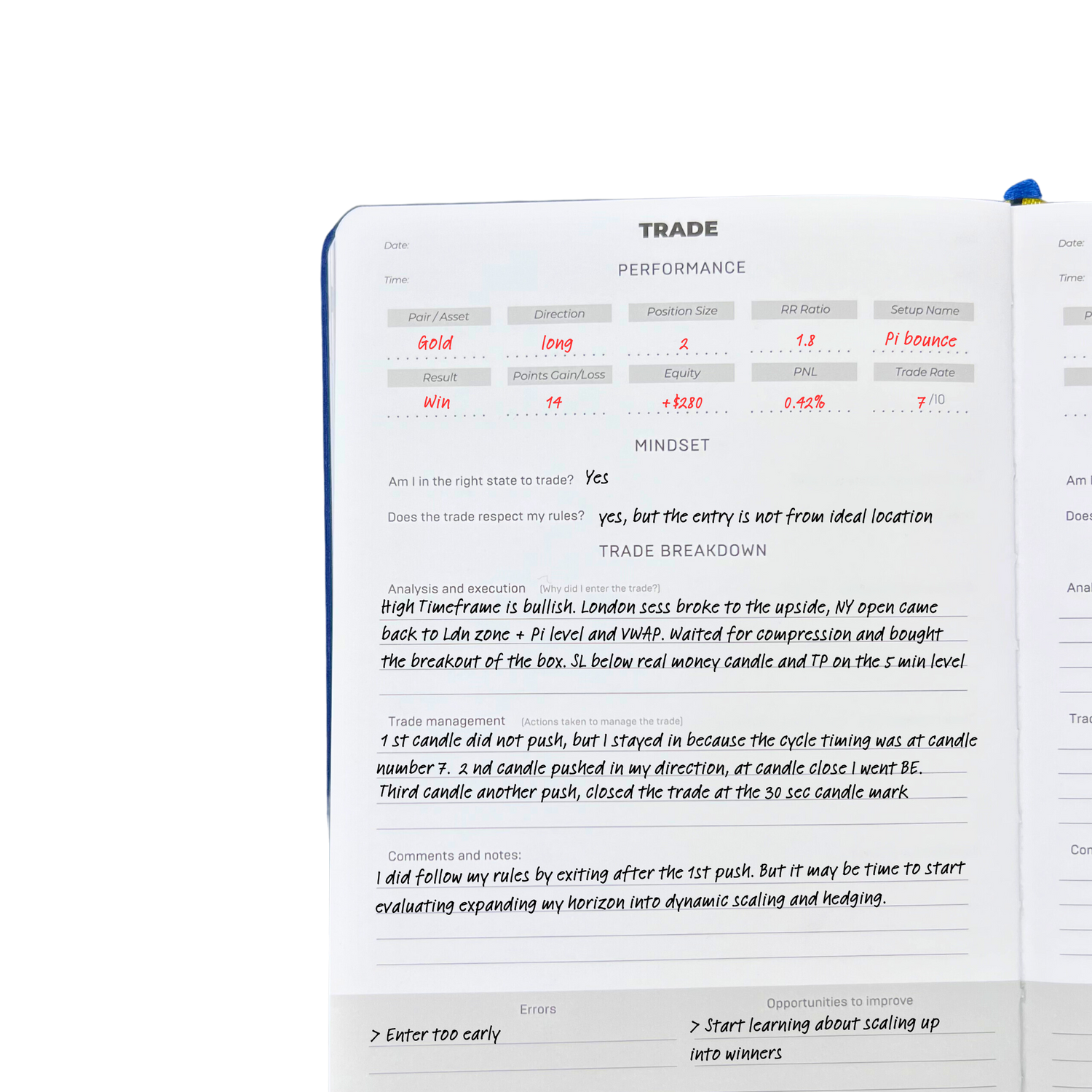

Tackle Each Trade

Reviewing your trades in hindsight has an immense mental and performance benefit. 4X Journal will give you a simple but effective way of organizing your thoughts, improve your trading and make long lasting changes.

Weekly Review Your Craft

Summarize what happened during the trading week. Define the actions you will take to improve in your Technical Skills, Mindset, and Trading Plan. Set the tone for the following week.

The Power Of A Single Habit

-

Keep Yourself Accountable

Trading is a lonely business. Look after yourself and stop bad decisions.

-

Increased Focus And Clarity

Journaling makes sense of cluttered thoughts, giving you more space to focus on what's important.

-

Less Stress. More Sleep.

Writing down your thoughts and feelings about your trading reduces stress and anxiety, improving the quality of your life.

-

Higher Success Rate

It's scientifically proven that you're 42% more likely to achieve your goals when you write them down.

-

Boost brain function.

Not only does it boost your working memory, journaling also helps decision-making and cognitive processing.

-

No More Burnout

Journaling's proven to boost your immune system and improve mental recovery times and symptoms of burnout.